Chinese corporate investors faced challenges and uncertainties in 2023 from a mix of political and economic factors in Europe and globally. Uncertainty about the global economy impacted the investment environment for Chinese firms, amid rising geopolitical tensions that include the protracted war in Ukraine and new conflict in the Middle East. China’s lackluster growth in the post-Covid period has weakened the financial footing of many Chinese firms.

Strict capital controls and the depreciation of the Chinese yuan (CNY) also disincentivized outbound investment. The European Union (EU) is seeking to recalibrate the EU-China relationship and strike a balance between de-risking and cooperation, a shift that has stoked the uncertainties facing potential Chinese investors. This all happened amidst enhanced oversight of foreign investment as economic security has risen up the agendas of European governments.

Many of these factors have been present for several years, contributing to the steady decrease in investment flowing from China into Europe. In 2023, Chinese investment in the EU and the UK (hereafter referred to collectively as “Europe”) slipped further, though only marginally, from €7.1 billion in 2022 to €6.8 billion. This was the lowest level of investment seen since 2010. At the same time, an uptick in newly announced greenfield investments suggests that the precipitous decline in Chinese investment since 2016 may be levelling off, as investment in the electric vehicle (EV) sector continues.

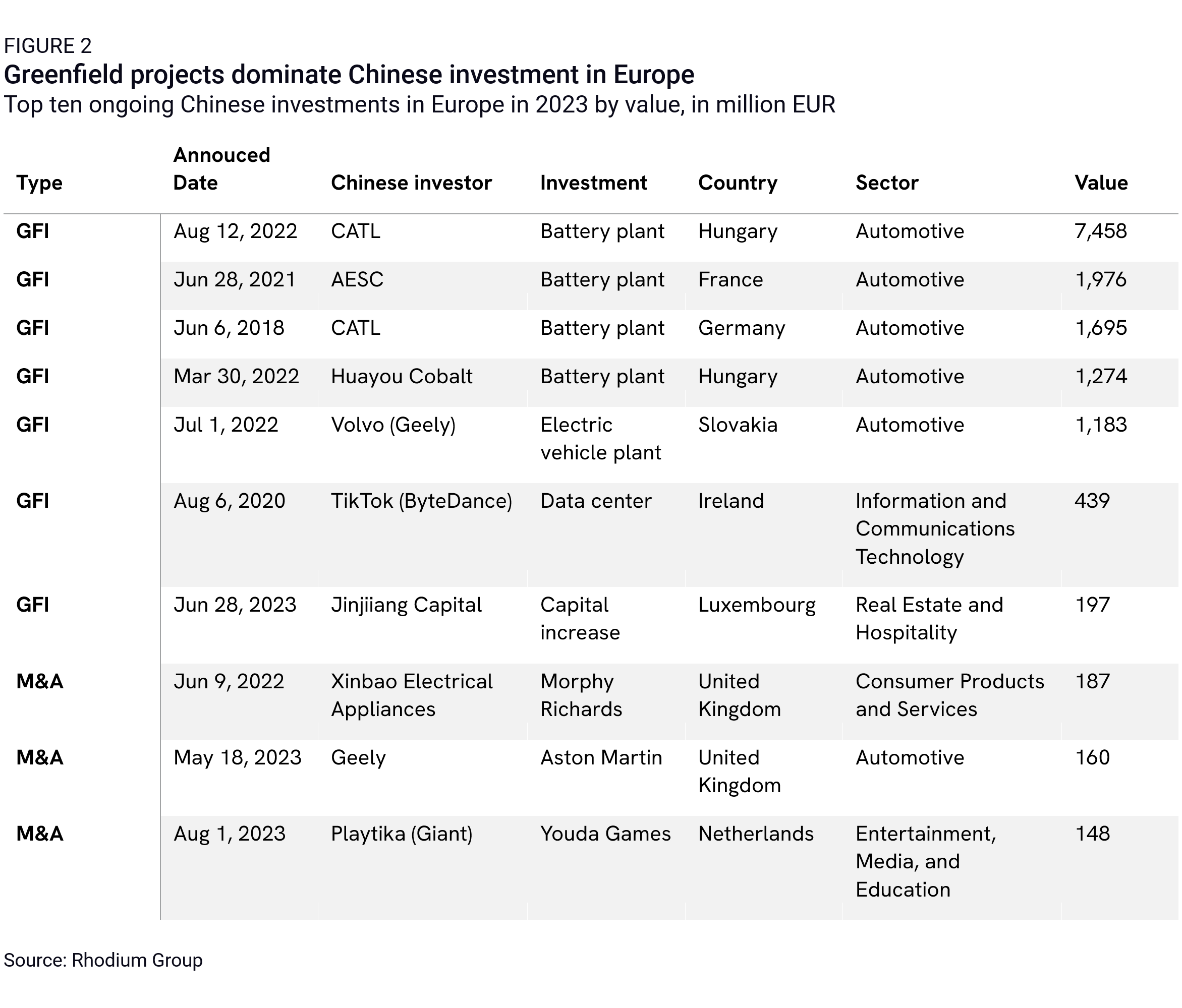

The make-up of Chinese investment in Europe is undergoing a fundamental shift as greenfield projects are becoming the dominant form of investment. The share of greenfield investment (GFI) has increased from a mere two percent in 2017 and an average of nine percent between 2012 and 2021, to 51 percent in 2022 and as high as 78 percent in 2023.

A series of multi-billion-euro investments in battery and EV plants across Europe pushed Chinese greenfield investment to €5.3 billion in 2023, up 48 percent on 2022. By contrast, the value of M&A investments declined again in 2023, by 58 percent, to only EUR1.48 billion—their lowest value since the global financial crisis in 2009. This was the result of fewer acquisitions overall, smaller average deal size and the absence of billion-euro M&A deals.

Major deals had a big impact on the aggregate figures in recent years, including Hillhouse Capital’s acquisition of Philip’s household appliances business for €3.7 billion in 2021, and Tencent’s acquisition of British video game maker Sumo Digital for €1.3 billion in 2022. In 2023, no single deal exceeded €200 million—compared to seven in 2022, and five in 2021.

The main causes of this continued decline likely include economic headwinds and strict capital controls within China, alongside increased scrutiny of Chinese investments in Europe. Weak global economic growth and rising geopolitical tensions may also have dampened the appetite of Chinese investors for overseas investment.

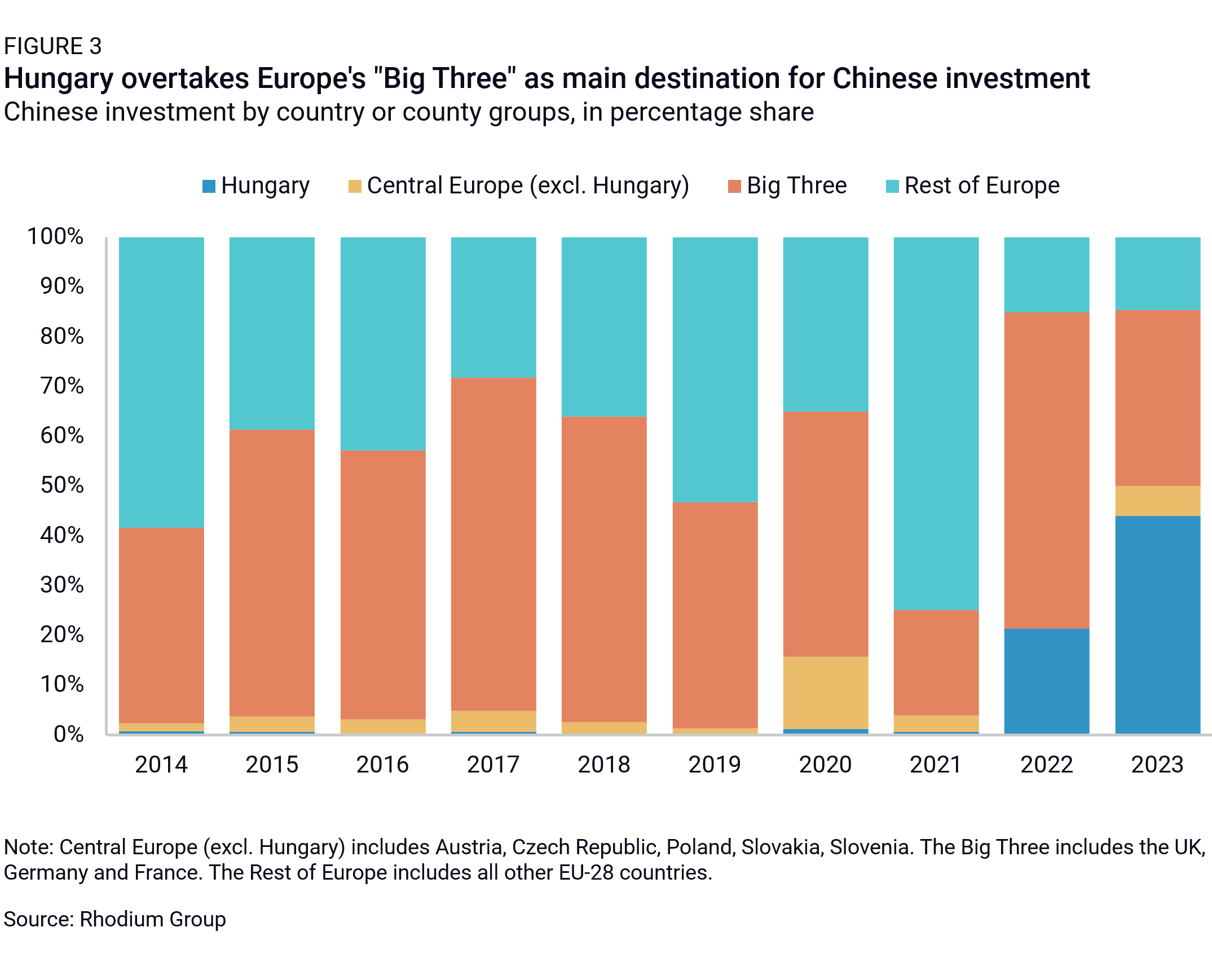

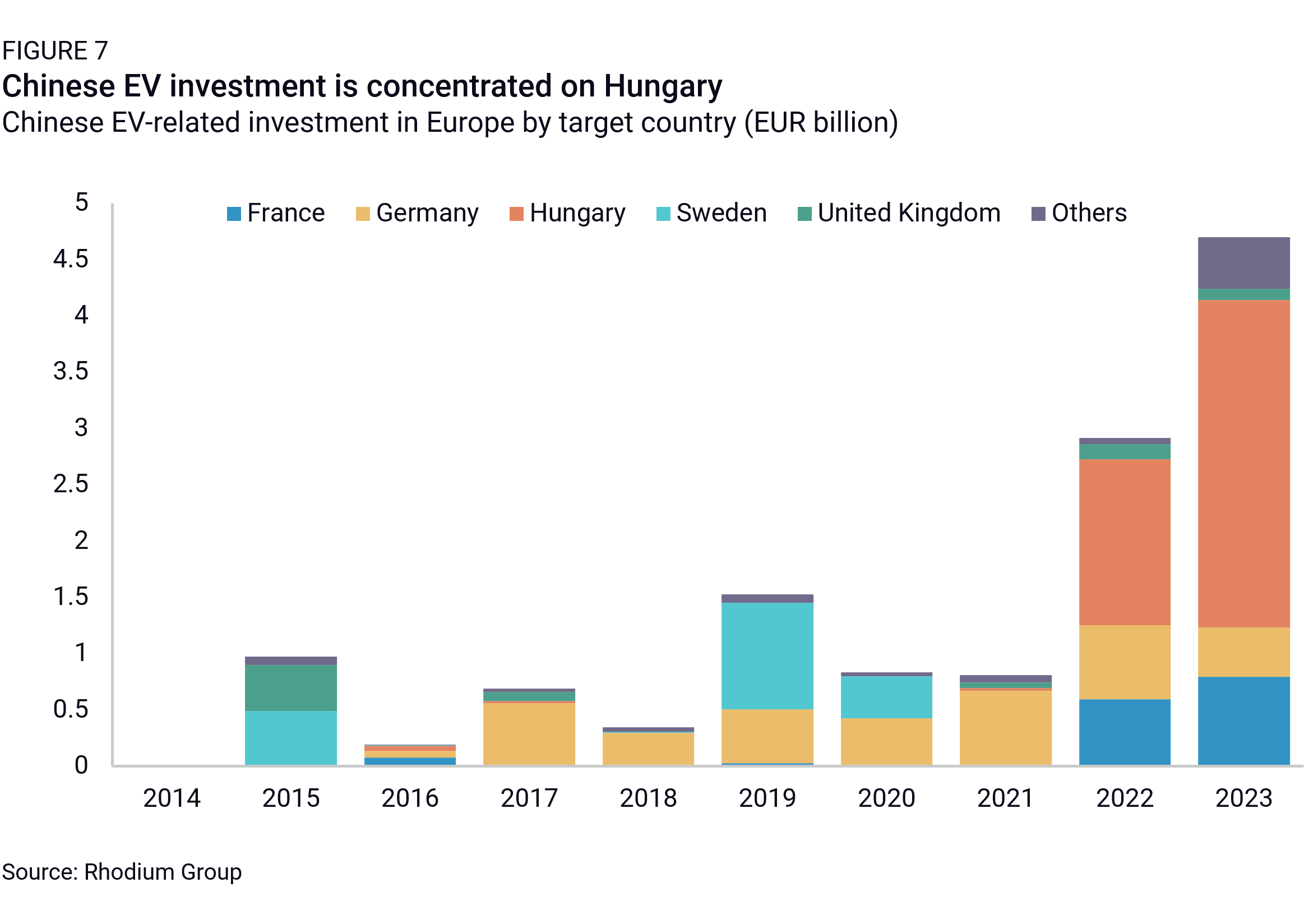

Large scale battery and EV investments have led to a dramatic shift in the regional distribution of Chinese investment in Europe, turning Hungary into their primary beneficiary. Investment in the country has skyrocketed in the last two years, up from a very low base.

Between 2012 – 2021, average annual investment into Hungary was just €89 million. In 2022, it rose to €1.51 billion, and reached €2.99 billion in 2023. The steep rise was due to large-scale investments in battery plants built by CATL and Huayou Cobalt.

As a result, Central Europe has become the most important destination for Chinese investment. Hungary alone captured 44 percent of all Chinese FDI into Europe, or more than the “Big Three”—France, Germany, and the UK—combined. Poland, the Czech Republic and Slovakia also received some investment in 2023. The latter received €364 million in Chinese FDI, with major investments including Volvo’s (majority owned by Chinese firm Geely) EV battery plant and Gotion High-Tech’s acquisition of a 25 percent stake in Inobat.

By contrast, the share of investment going to the “Big Three” countries declined to 35 percent in 2023, compared to an average share of 53 percent between 2013 – 2022. In value terms, investment in the “Big Three” fell by 47 percent between 2022 and 2023, from €4.5 billion to €2.4 billion. Despite this decline in investment flow, these countries still account for more than half (55 percent) of all cumulative Chinese investment in Europe since 2000.

In comparison, countries beyond Hungary and the “Big Three” received very little investment from Chinese firms. While these other countries attracted about half (48 percent) of Chinese investment on average between 2012 and 2021, In 2022 and 2023 this share amounted to just 15 and 20 percent respectively.

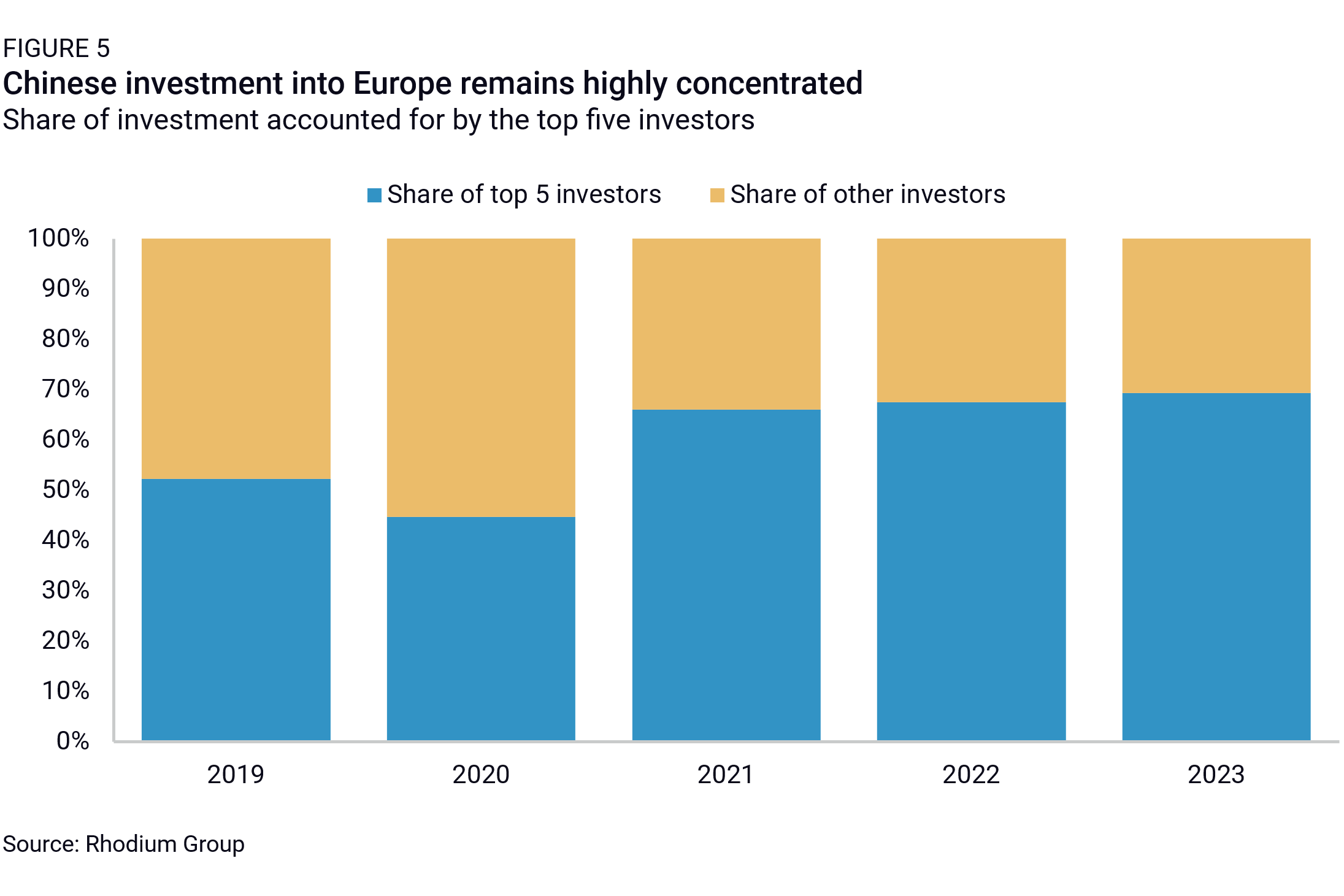

As overall investment levels have come down, the relative importance of individual deals and investors has increased. The top five Chinese investors consistently made up two thirds of all Chinese investment into Europe between 2021 and 2023, compared to 45 percent in 2020. Private firms engaging in greenfield projects or major acquisitions were the driving force behind this high level of concentration, particularly CATL’s battery plant projects in Hungary and Germany in 2023 and 2022, as well as Hillhouse Capital’s acquisition of the Philip’s household appliances business segment in 2021.

In 2023, the top four investors were all active in the EV or battery industries, and together accounted for 66 percent of total investment—also a side-effect of the sharp drop in major deals in other sectors.

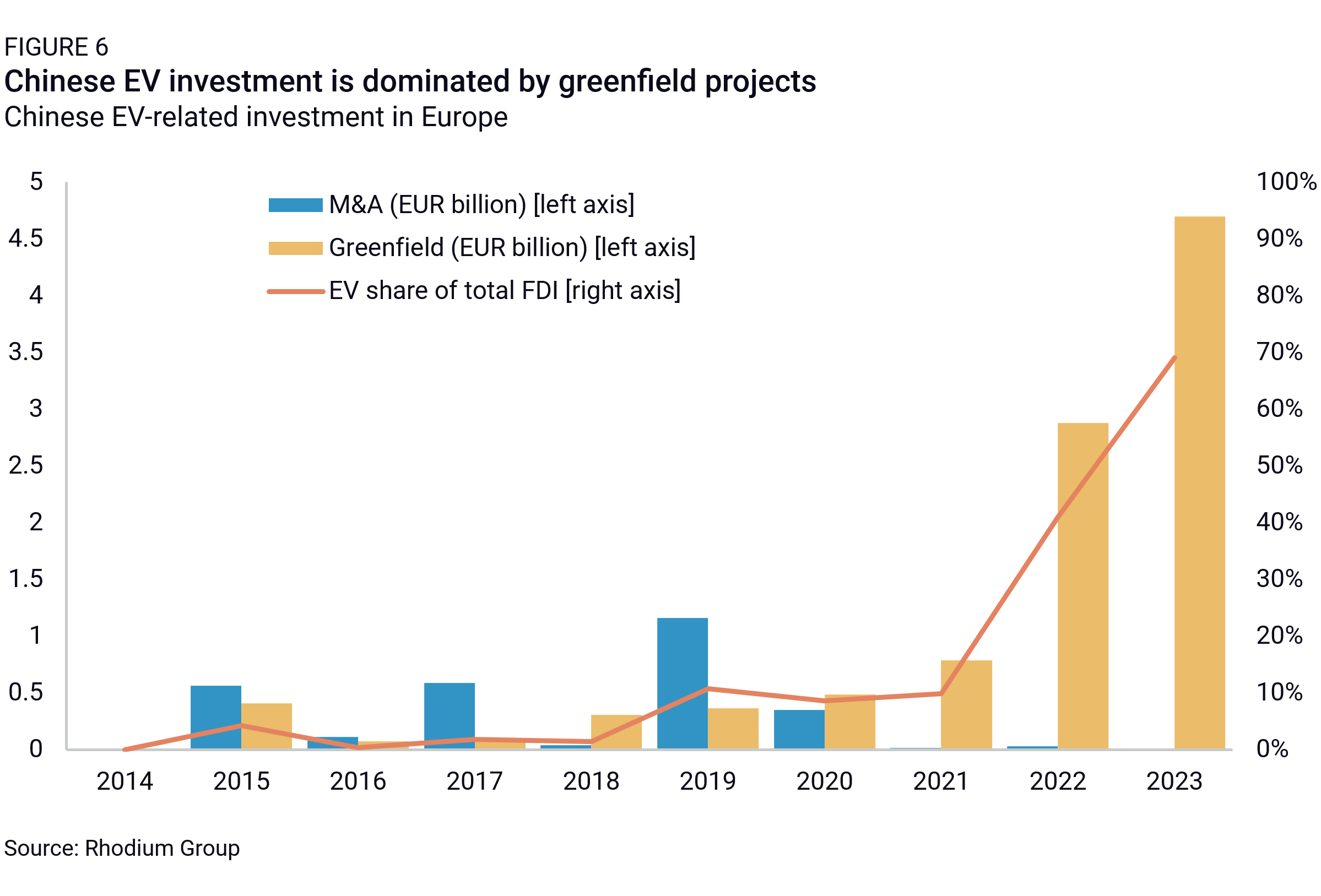

The past two years have seen a significant surge in Chinese investment in the EV value chain in Europe. In 2023, Chinese EV-related investment amounted to €4.7 billion, or about 70 percent of total Chinese FDI in the EU, which was another sharp increase (up 61 percent) on the previous year’s €2.9 billion.

As in 2022, the bulk of that investment came from a handful of billion-euro investment in battery plants. Leading Chinese battery manufacturers CATL, AESC and Svolt contributed 85 percent of the total EV-related investments. CATL has established a battery plant in Germany and is currently constructing a €7.3 billion battery plant in Debrecen, Hungary. AESC is investing in plants in Douai, France, worth €2 billion and in Sunderland, UK, worth €1.3 billion.

The trend is likely to continue. AESC announced a further project in Spain worth €2.5 billion that is expected to break ground in 2024. Svolt is planning to build two battery projects in Germany but has run into local opposition. Finally, Eve Energy has announced a battery investment worth €1 billion in Hungary.

Chinese FDI is increasingly moving both up- and downstream along the EV value chain. Chinese suppliers of battery inputs like cathodes and anodes—leaders in their respective part of the battery supply chain—are trying to expand their market share in Europe’s rapidly growing battery ecosystem. CATL-supplier Semcorp commenced operations of its €340 million lithium-ion separator factory in Hungary in 2023. Two Chinese firms, Putailai and Shanshan, unveiled significant investments in Sweden and Finland, worth €1.5 billion and €1.3 billion respectively, which focus on anode material production. These are likely to break ground in 2024.

There are also signs that Europe could soon see more downstream investments in EV production. In Slovakia, Geely-owned Volvo is already constructing an EV plant with a price tag of €1.2 billion. In December 2023, China’s leading EV-maker BYD announced plans to produce EVs in Hungary by 2026. The value of BYD’s investment has not yet been disclosed, but construction kicked off in early 2024. In April 2024, Chery and Spain’s Ebro EV Motors announced plans to invest €400 million to jointly produce cars in Barcelona. The EU’s ongoing probe into Chinese EV imports could incentivize further investments by Chinese EV producers to avoid potential duties on imports.

Geographically, China’s EV-related greenfield FDI remains heavily concentrated, with Hungary, France, and Germany collectively absorbing 88 percent of all EV-related investment. In 2023, even more than in 2022, Hungary was a clear frontrunner. The new greenfield investments from BYD, in addition to investments from Semcorp, CATL and Huayou Cobalt mean Hungary is likely to stay among the top recipients of Chinese FDI in the coming years. France and Germany, for their part, attracted €790 million and €438 million in EV-related investment respectively. Battery investments in these countries are linked to supply contracts with local carmakers: AESC in Douai supplies Renault, while CATL in Debrecen serves BMW and Mercedes in Germany and Hungary.

Chinese firms might feel that their investment is safer in a country like Hungary that has close ties to Beijing than in other destinations, like Italy, that have recently increased regulatory scrutiny over corporate governance at Chinese companies. But Hungary’s top position in attracting EV investment is not limited to Chinese companies—and hence not just a geopolitical feat. South Korean firms, too, have increased their FDI footprint in Hungary—likely because the country hosts several leading carmakers, offers cheap and skilled labor, doles out millions of euros in subsidies, and has promised to build infrastructure and industrial parks around the investments.

China’s EV investment is not limited to Europe. Battery and EV producers have also announced huge investments in Asia, Latin America and North Africa. Many of these investments are fueled by local content requirements in host countries and, crucially, the US Inflation Reduction Act that requires certain raw materials to be processed in the United States or its free trade partners.

In Europe’s immediate neighborhood, Chinese companies have announced major EV- related investments, including by Gotion High-Tech and CNGR in Morocco. Its large reserves of phosphate, a key component in lithium-iron phosphate batteries, make Morocco an attractive destination for Chinese EV investors. The kingdom also boasts a Free Trade Agreement (FTA) with the United States and the EU and hosts several French carmakers’ plants, which are intended for shipping into the European market. Morocco would become an even more attractive manufacturing hub if the EU decides to impose duties on China- made EVs.

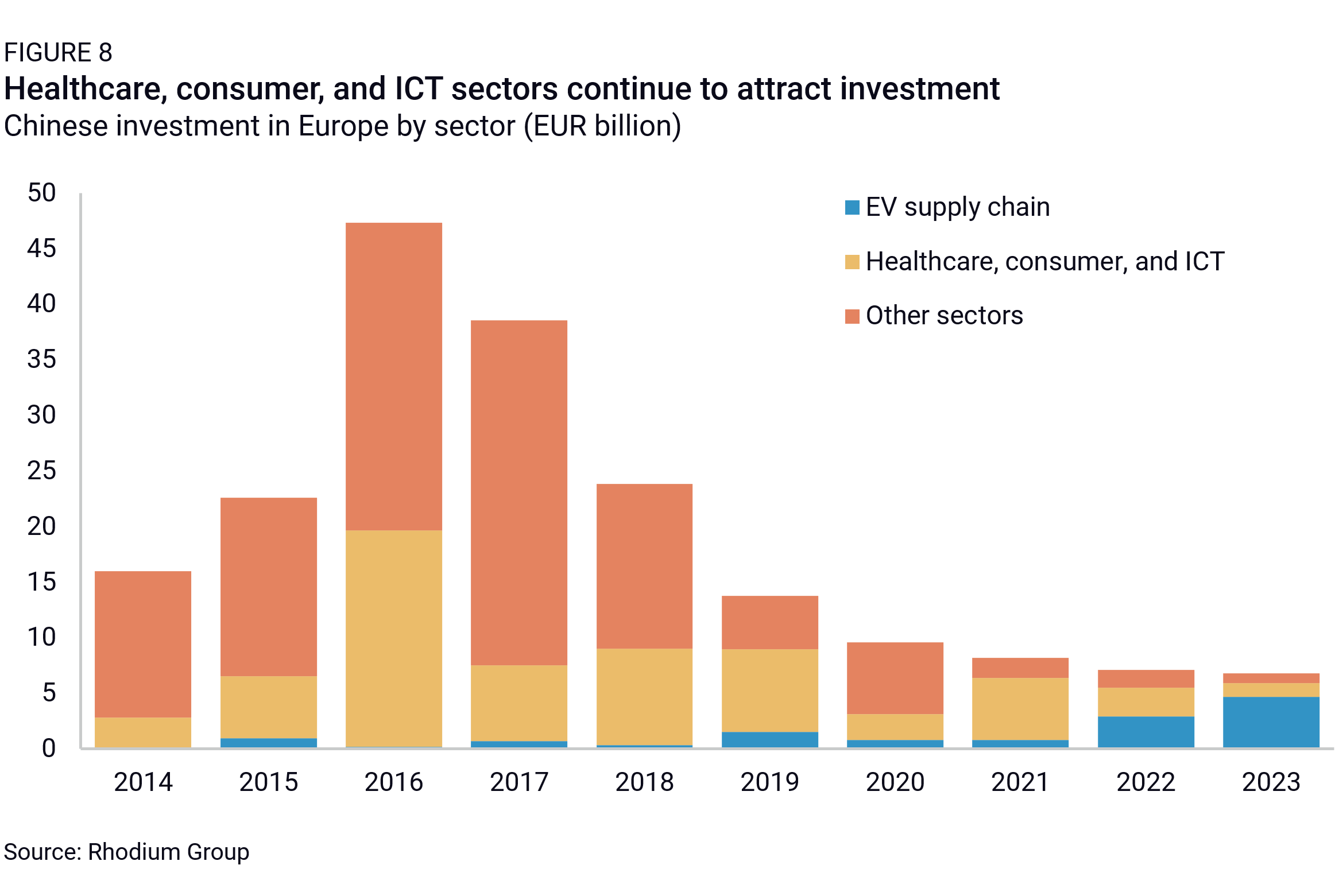

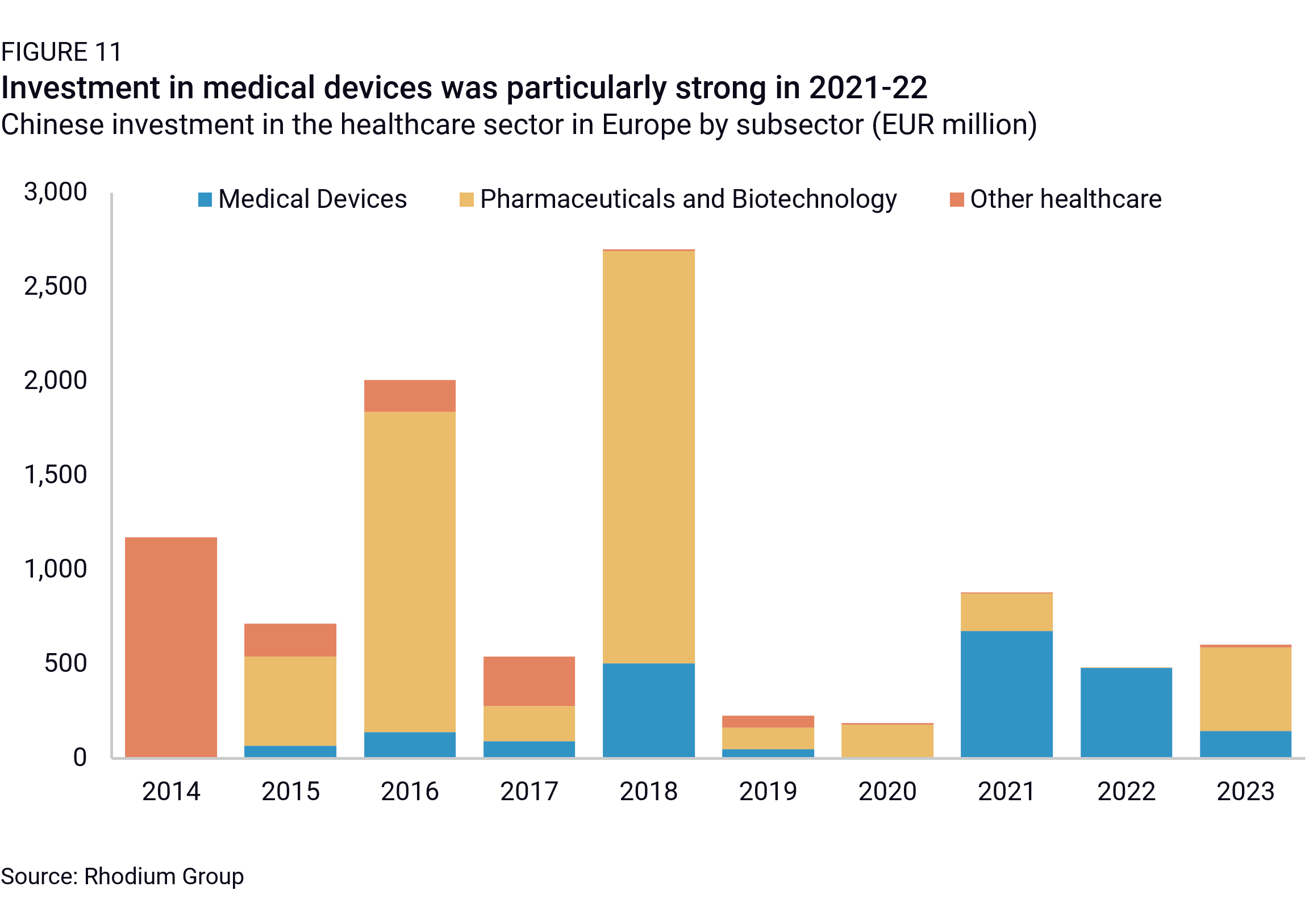

The sheer volume of Chinese EV-related FDI in Europe masks the fact that a handful of sectors have also attracted continuous Chinese investor interest, albeit at lower volumes. Healthcare is emerging as the second largest sector for Chinese investment (see our deep-dive in 2.2), with growing interest in the medical devices sector. The consumer goods and entertainment sectors—typically considered less sensitive than infrastructure, energy or high-end electronics—also remained a major focus for Chinese investors. Finally, ICT investment has remained resilient, partly due to the tightening of Europe’s data regulation regimes.

Beyond EV, the healthcare, consumer-oriented (consumer products, entertainment), and information and communication technology (ICT) sectors have continued to appeal to Chinese investors, attracting as much as €3.1 billion in annual Chinese FDI on average during 2021—2023. Although this was only half the average annual investment of the previous decade (€6 billion), it was a far more moderate decrease than in other sectors like transport, real estate or financial and business services, where investment values have by now plummeted by more than 90 percent.

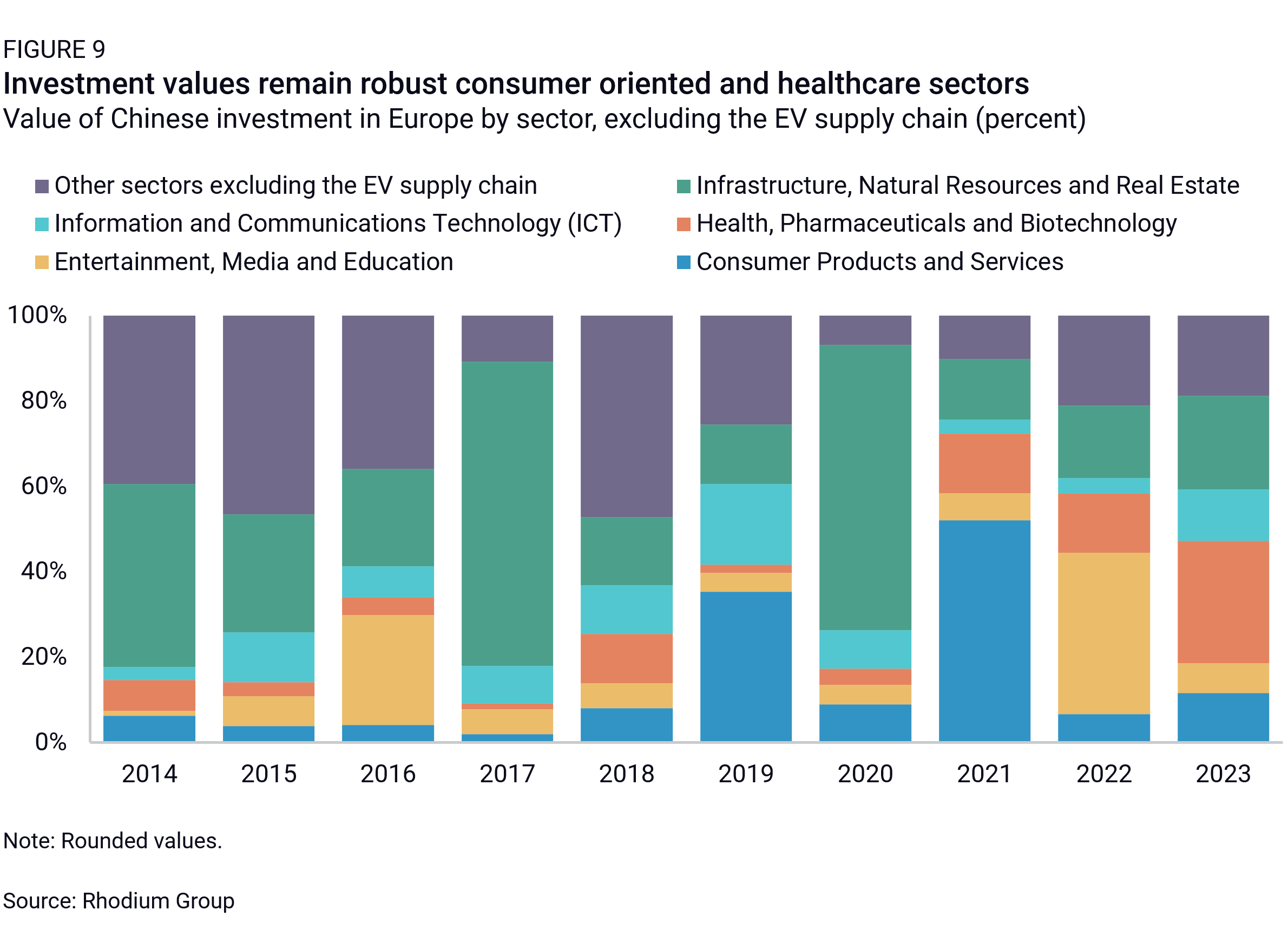

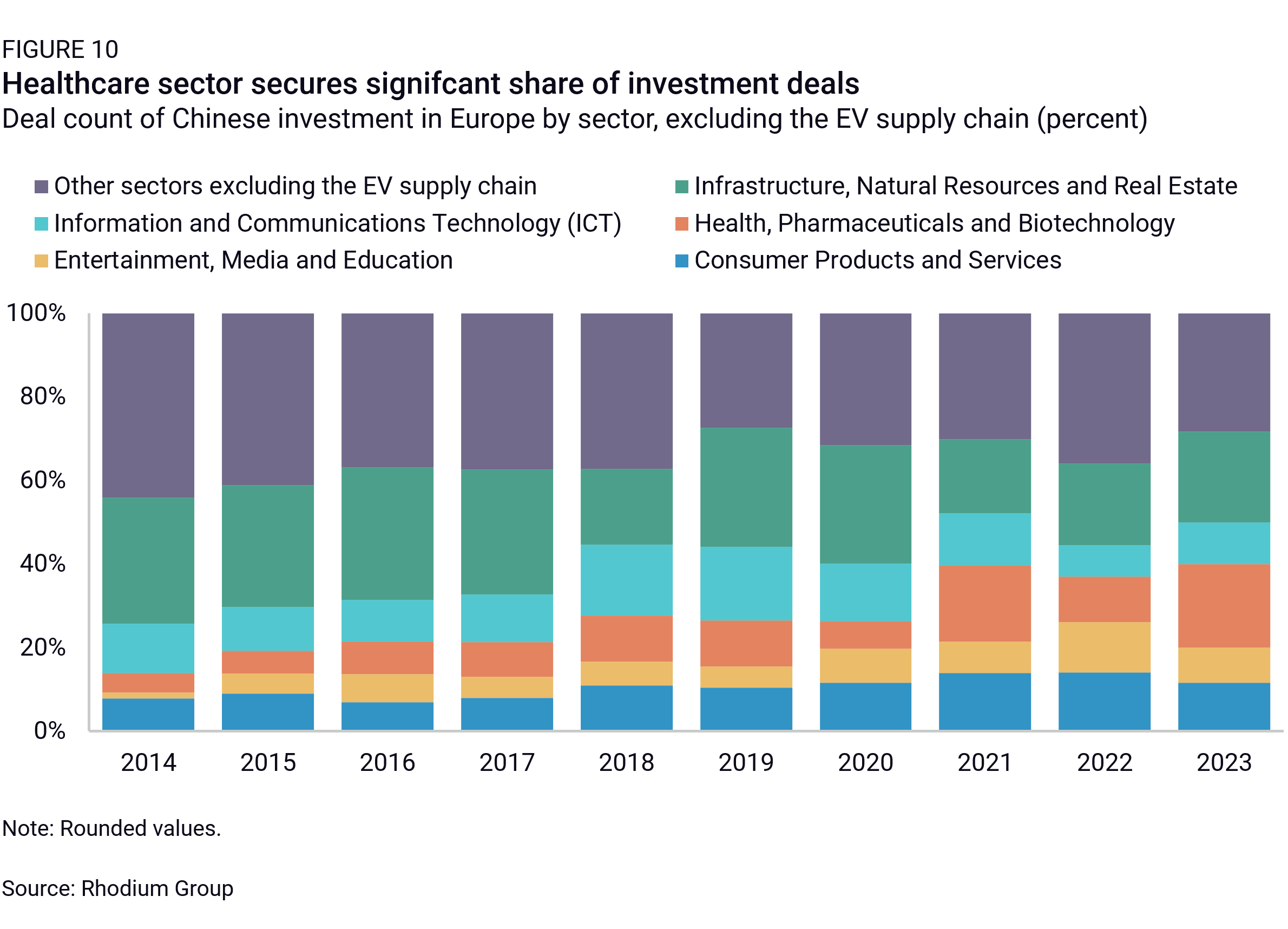

The healthcare, consumer, and ICT sectors now absorb about 70 percent of non-EV-related Chinese FDI in Europe, doubling their 35 percent share from 2014 to 2023. They also secured half of the non-EV transaction count in the last three years, up from approximately 37 percent the previous decade.

The resilience of the entertainment and consumer goods sectors has been underpinned by their ability to attract multi-billion-euro deals in recent years. In 2021 and 2022, such significant acquisitions included Hillhouse Capital’s purchase of Philips’ home appliance business unit and Tencent‘s acquisition of video game studio Sumo Digital. In fact, unlike EV-related FDI activity of the past three years, most investments in these sectors took the form of acquisitions, with a significant geographic concentration in the “Big Three” economies of France, the UK, and Germany.

The consumer goods sector alone accounted for 32 percent of non-EV-related investment value over the past three years, while entertainment and healthcare both drew 16 percent each.

Persistent Chinese investor interest in these sectors is linked to a combination of push and pull factors. The entertainment sector is facing a tighter regulatory environment at home, as Beijing’s tech rectification campaign aims to redirect investment towards strategic industries rather than consumer-oriented sectors. For firms like Tencent, well-capitalized and competitive, with accumulated knowledge of the video game industry, it makes sense to look for new, more lucrative opportunities overseas.

The European regulatory environment has also been permissive to many of these consumer- oriented investments, unlike more sensitive sectors. Indeed, the increased scrutiny of Chinese investment in critical infrastructure or semiconductors over the past five years may partly explain the recent focus on consumer goods and services (if only because it has led to a drop in the number and volume of transactions in the transport or energy sectors).

As these conditions persist, we will likely continue to see large-scale acquisitions in the consumer and entertainment sectors. Although no billion-euro acquisitions were recorded in 2023, Tencent acquired a majority stake in the Polish video game studio Techland in January 2024 for €1.5 billion.

Lastly, Europe’s tightening data governance regime was a big factor in convincing ICT companies to establish operations on the ground in Europe (including TikTok owner ByteDance). The shift can be seen in the dramatic rise in the proportion of greenfield investments within the sector, up from 10 percent of total ICT investment in the past five years to 45 percent between 2021 and 2023.

Healthcare stands out as a sector that has attracted robust interest from Chinese investors in recent years. Average annual investment in healthcare has remained relatively steady, at €990 million over the last decade, and €738 million over the last three years. This means the sector accounted for 14 percent of non-EV FDI between 2021 – 2023, compared to just 3.4 percent between 2014 – 2020.

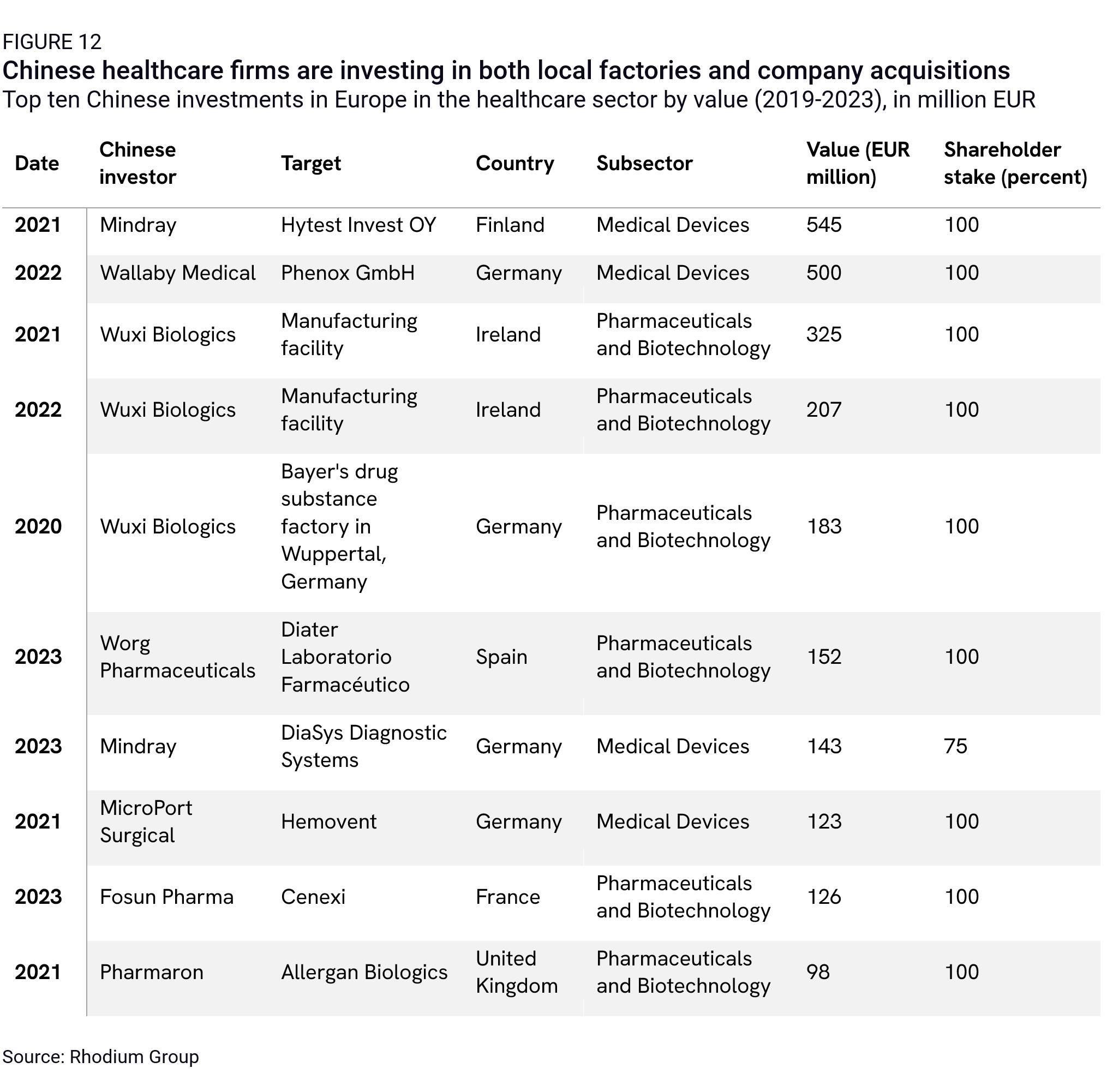

This made healthcare the second most significant sector for Chinese FDI in Europe in 2023. Previously, the investments in the sector were primarily driven by pharmaceuticals and biotechnology, which accounted for 58 percent of sectoral FDI over the past decade. However, in the last three years, medical devices have emerged as the predominant area of interest, attracting 66 percent of the total investment value between 2021 and 2023. The biggest investment in 2023 was Mindray Medical’s acquisition of German-based DiaSys Diagnostic Systems for €143 million (Mindray is China’s largest medical device producer).

Medium-sized acquisitions have dominated FDI in the sector, but Chinese companies have also expanded their manufacturing capabilities in Europe recently. The most notable examples include WuXi Biologics’ construction of two production bases in Ireland for a total of €532 million and its plans to expand its German assets after acquiring two plants from Bayer in 2020 and 2021. Mindray’s purchase of DiaSys Diagnostic Systems included a global manufacturing network, now also available for Mindray’s operations.

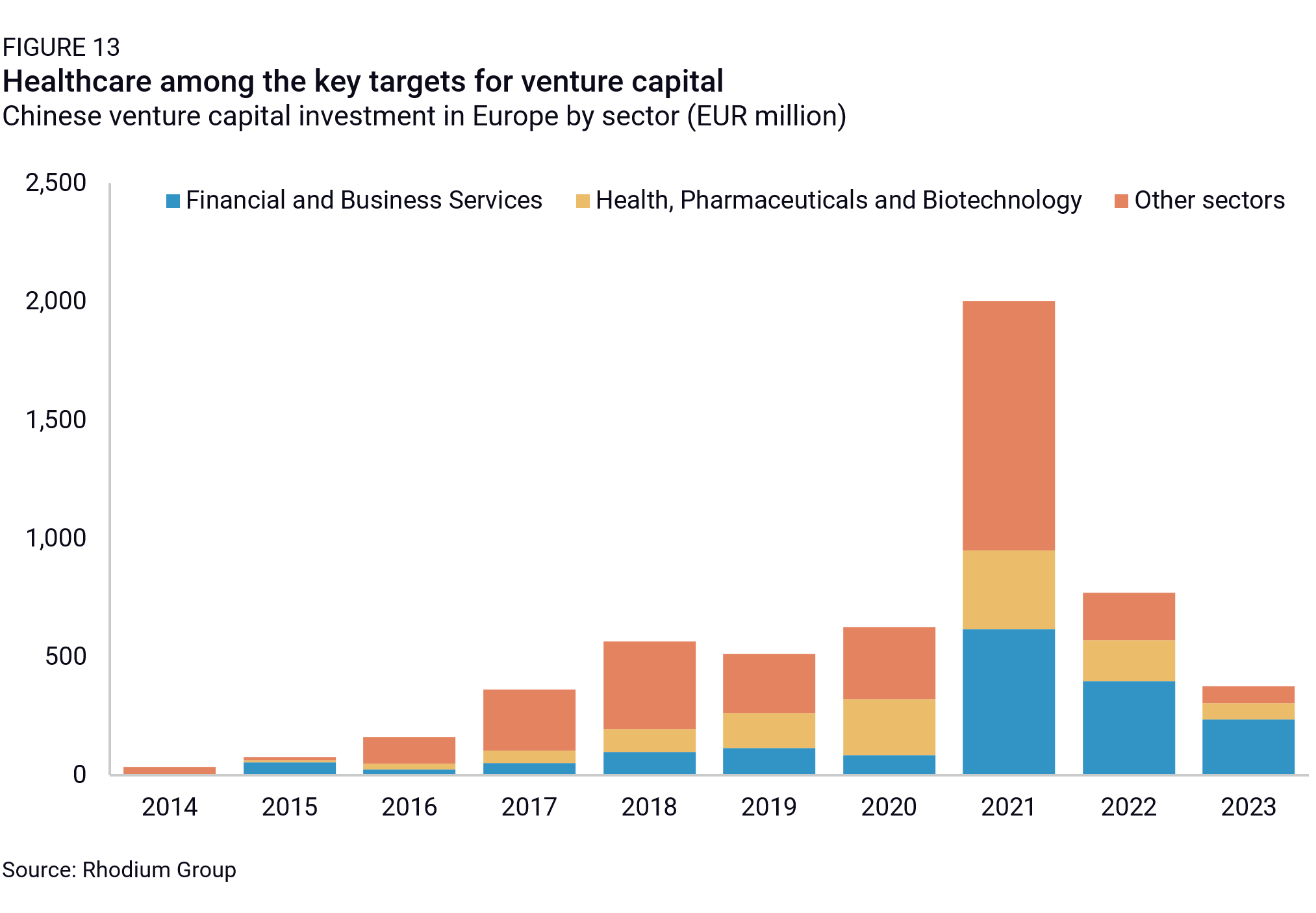

The healthcare sector was also a top destination for Chinese venture capital. Amid a drastic decline in Chinese startup funding in Europe, healthcare has remained the second highest recipient of Chinese venture capital for the past five years, capturing 24 percent on average of all VC investment. In 2023, the largest deal was Tencent’s investment in British medical robotic systems developer CMR Surgical, for an estimated €17 million—showing that the sector interests non-healthcare Chinese technology players too.

So far, there have been few examples of investments in the healthcare industry being blocked, in contrast, for example, to investments in critical infrastructure or semiconductors. However, the Covid-19 pandemic highlighted the industry’s crucial importance and Europe’s significant over-exposure to China for critical goods like personal protective equipment. Unsurprisingly, therefore, the takeover of Heyer Medical (a ventilator manufacturer) by Chinese ventilator and anesthesia machine manufacturer Aeonmed was initially blocked by the German government in 2022. However, this decision was annulled by a local court after an appeal in 2023.

Scrutiny of Chinese investment in the healthcare sector is likely to increase. In 2023, the European Commission listed biotech among Europe’s top four critical technologies for its economic security strategy—launching a risk-assessment of the sector that could trigger more restrictions. These may include enhanced investment-screening scrutiny.

In April 2024, the EU also announced a probe into China’s public procurement of medical devices—the first ever activation of EU’s International Procurement Instrument (IPI), and a sign that the healthcare sector is getting more attention among European policymakers. The probe may result in reciprocal restrictions on Chinese firms’ participation in EU procurement tenders.

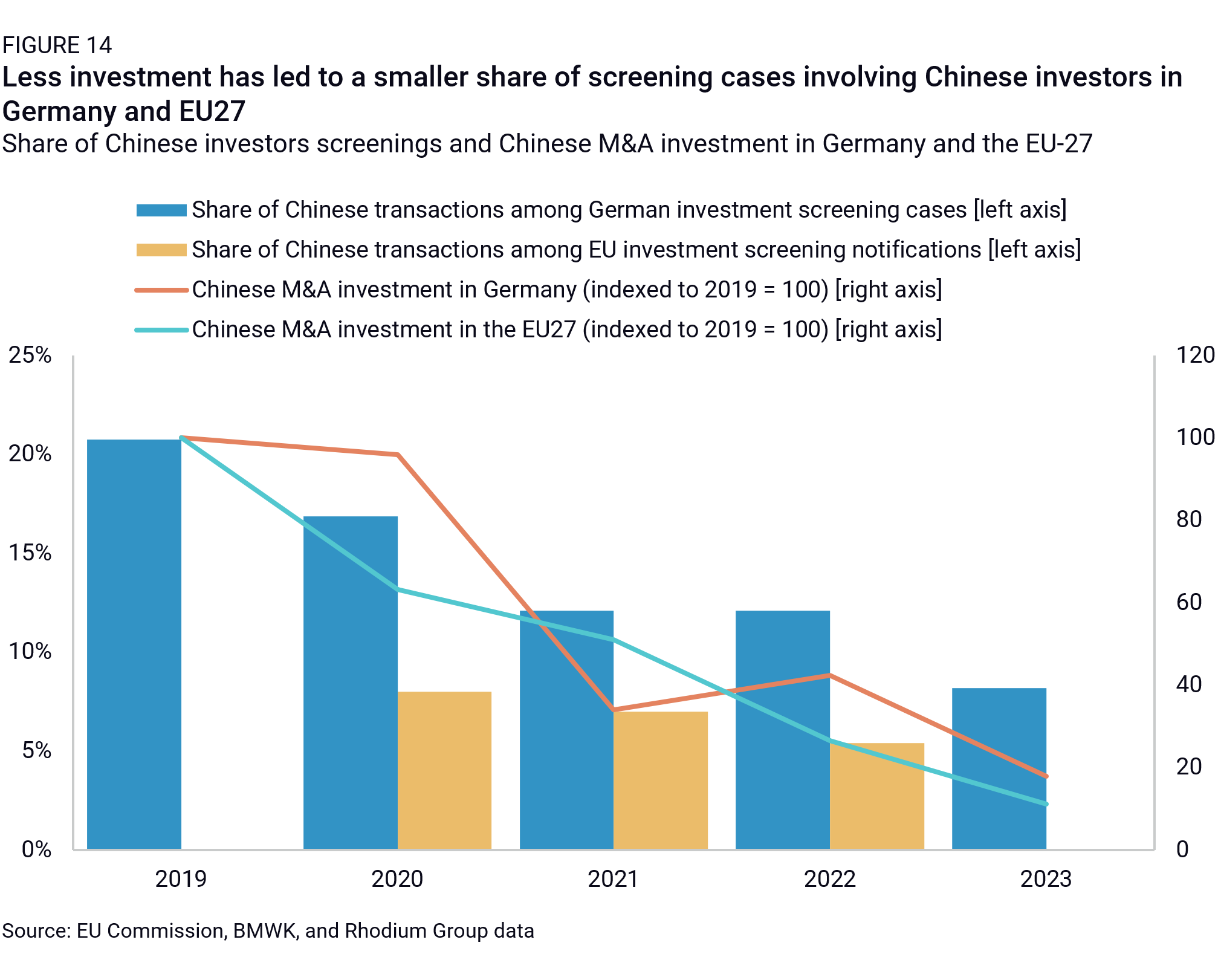

The proportion of transactions reviewed by screening authorities in Europe related to Chinese firms has been on the decline in recent years, roughly tracking the fall of Chinese FDI in Europe. The share of investment screening notifications submitted to the European Commission, where the ultimate shareholder originated in China, declined from 8 percent in 2020 to 5 percent in 2022 (the last year for which data is available).

The data for Germany reflects a similar trend, with the share of screened investments where the acquirer is a Chinese firm falling from 17 percent in 2020 to 12 percent in 2022 and just 8 percent in 2023. Lower levels of investment from China have likely contributed to this reduced share. Another possible reason is that Chinese firms have become more wary of acquiring firms from certain European countries, or in certain more sensitive sectors, due to increased regulatory oversight.

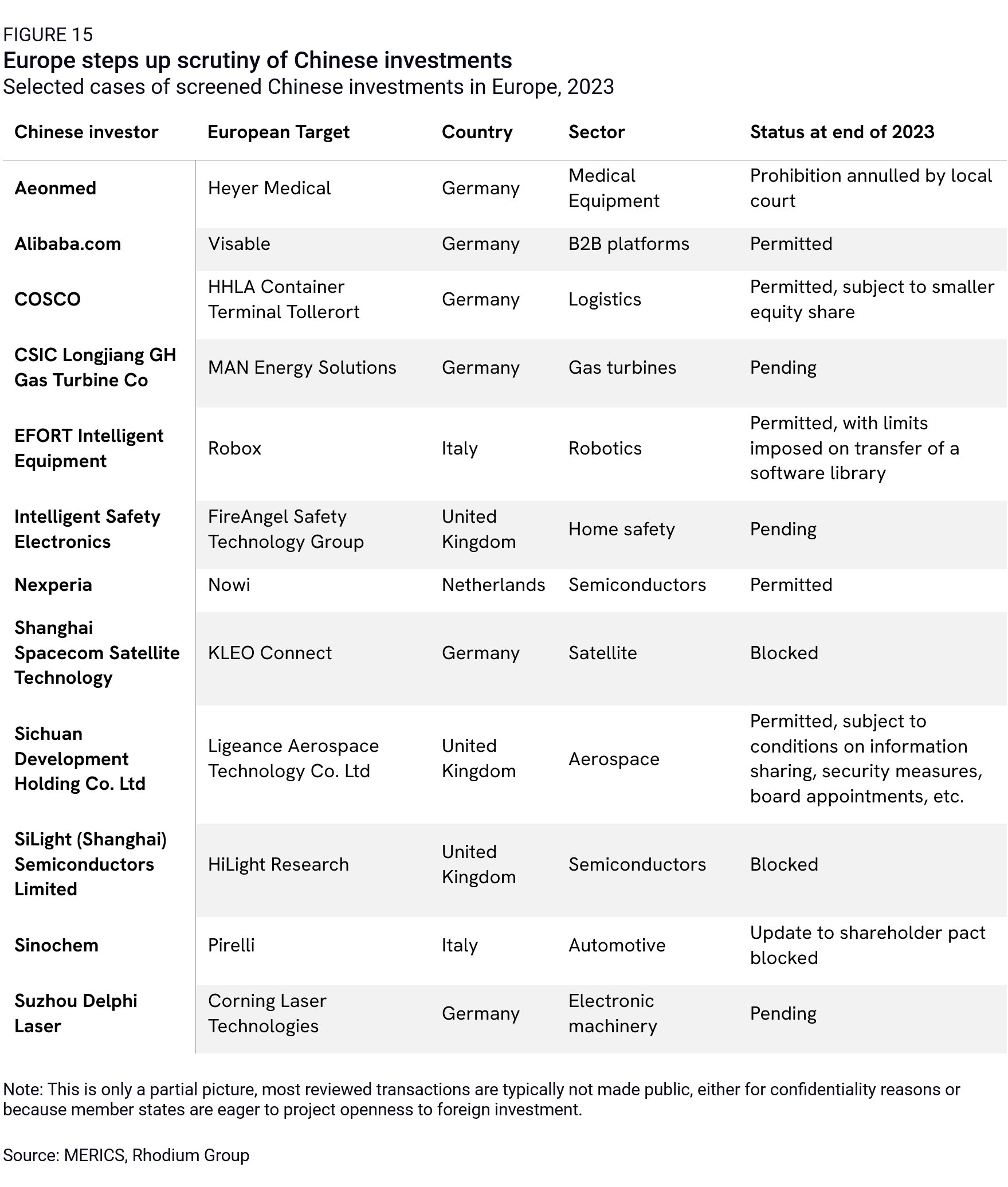

The details of individual investment screening cases are rarely released to the public. Ongoing investigations may be confidential or sensitive. Governments are also wary of damaging their reputation as an attractive destination for foreign investment. We could only identify 12 publicly-reported cases where an investment screening review was launched, or where a decision was made in 2023 (many more have likely taken place).

Five deals were in strategic sectors, such as semiconductors, aerospace, gas turbines, and satellite technology, where national security considerations were likely a key consideration for home governments. Two of these deals were blocked, two were permitted and one decision is still pending (on the acquisition of the gas turbine business of MAN Energy Solutions by CSIC Longjiang GH Gas Turbine).

In addition, the Italian government exercised its authority under the “Golden Power Procedure” rules to intervene in the updated shareholder agreement between tire manufacturer Pirelli and its largest shareholder, China’s Sinochem, to ensure Pirelli’s independence.

EU efforts to encourage member states to adopt investment screening measures have already brought significant results. Of the EU’s 27 member states, 24 had passed legislation by April 2024 enabling them to conduct investment screening (double the total number in 2017). Only Greece, Croatia, and Cyprus still lack an investment screening regime, though Cyprus is expected to introduce one in 2024.

Six countries either introduced new regimes or updated existing ones between January 2023 and April 2024. The most notable changes were in Belgium and Estonia, where investment screening mechanisms came into force. Ireland signed the “Screening of Third Country Transactions Act 2023”, which is expected to come into force by mid-2024. Bulgaria’s parliament amended the Investment Promotion Act in February 2024 to screen FDI for national security or public order concerns.

In January 2024, the EU put forward a proposal to further harmonize investment screening regimes across member states. The initiative would entail revisions to the EU FDI Screening Regulation, such that:

Any updates to the screening regulation are unlikely to come into force before 2026, given the pause for European elections in June 2024 and the EU’s lengthy legislative process. Even then, a transition period would mean changes could not take full effect until 2027. But the eventual impact of the proposed measures would be to increase scrutiny of investments in strategic areas and to strengthen efforts to identify the ultimate shareholders of companies. Chinese investors will need to anticipate a more rigorous regulatory environment as European governments become more cautious and expand their oversight. The hurdles for Chinese investment will get higher, particularly in sectors deemed strategic or sensitive.

Lower levels of Chinese FDI have become the new normal. This would remain true even if one or two large scale transactions in 2024 were to produce a jump in the value of Chinese investment in Europe. The ability of big, single deals to jolt the picture itself reflects the overall trend for lower FDI. In 2023, there was a dearth of multi-billion-euro transactions, apart from several ongoing EV-related greenfield investments, which have put a floor on annual aggregate investment values.

Yet the new normal has arrived and is likely to persist. This year, the EU and US elections will give investors added reasons to wait and see. Longer term factors that reinforce the trend include the greater focus on economic security, trade fictions (which could escalate) and uncertainty about the strength of China’s economy.

On the one hand, key motivations which could drive further Chinese investment in Europe include:

On the other hand, there is also a long list of constraining factors: