Posted on: June 19, 2024, 01:20h.

Last updated on: June 19, 2024, 01:20h.

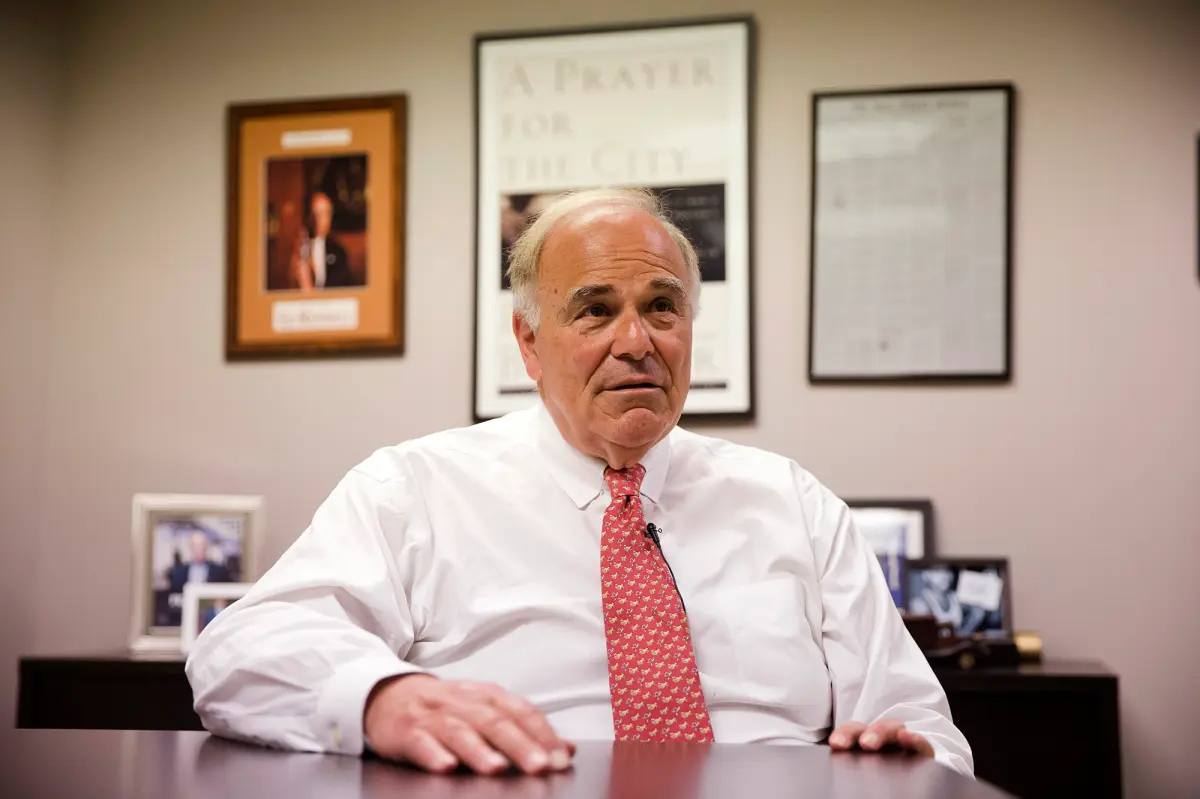

Former Pennsylvania Gov. Ed Rendell (D) says if lawmakers in Harrisburg want to create a regulatory environment for controversial grey gaming machines, they should impose a tax rate that mimics what casinos pay on their slots.

Rendell was governor of Pennsylvania from 2003 to 2011. During his time in office, Rendell championed the legalization of casino gambling, specifically slot machines.

Rendell writes that the casino industry heavily lobbied his administration during the state’s development of the Gaming Act passed in 2004. Rendell says casinos told him the 52% tax on gross revenue won by slots was far too high and would damper casino companies from investing in the state.

Two decades later, Pennsylvania is one of the nation’s richest gaming states with 17 brick-and-mortar casinos and an industry that generated a record $5.7 billion in revenue last year.

Skill games continue to operate across the commonwealth in a grey area inside restaurants and bars, gas stations, convenience stores, and other small businesses. Business owners say the machines, which unlike a slot require the player to identify a winning payline by tapping on the corresponding symbols, have provided critical revenue that has helped offset inflationary pressures. Revenue from the skill games is currently divvied up between the game’s software developer, machine manufacturer and distributor, and the host business.

State courts have ruled that skill games do not fall under the scope of the Gaming Act because they aren’t purely games of chance. Pennsylvania Attorney General Michelle Henry (D) is appealing the matter to the state Supreme Court.

In the interim, state lawmakers who have sided with the skill gaming industry have proposed legislation to regulate and tax the grey games. House Bill 2075, a bipartisan statute with 10 Democrats and 10 Republicans lending their support, would impose a 16% tax on the skill game win.

Gov. Josh Shapiro (D) has proposed a higher tax of around 42%. Rendell says both rates are erroneous.

I am alarmed to hear that several current members of the General Assembly are proposing a disastrous tax giveaway that I believe would benefit deep-pocketed, out-of-state gaming interests who have been flooding Pennsylvania with political campaign contributions. These interests operate another type of slot machine-style device that is self-serving called a ‘skill game,’” Rendell wrote.

“Rather than stick with the time-tested 52% tax rate that has served Pennsylvania well for nearly two decades, these legislators want to kill our golden goose and cut these out-of-state interests a sweetheart deal that would tax their machines somewhere between a laughable 16% or a clearly non-uniform 42%,” the former governor continued. “This is the definition of fiscal irresponsibility, in my opinion. Our legal gaming industry has already proven that all forms of slot machine-style gaming in the commonwealth, including the type most similar to skill games — specifically, VGTs — can operate successfully at the 52% rate.”

VGTs, or video gaming terminals, are allowed inside diesel truck stops. VGT revenue last year totaled $41.2 million — down slightly from the machines’ banner year of $42 million set in 2022.

HB 2075 was introduced in February and directed to the House Gaming Oversight Committee. The skill game measure has since sat unacted on.

While the 2024 Pennsylvania General Assembly’s session runs through Nov. 30, the House Gaming Oversight Committee does not currently have any scheduled meetings.