“India‘s politicians are often criticised for focusing on visible outcomes. But fixing infrastructure most voters do not see and simplifying rules most do not consider show that the state is capable of enacting deeper reform,” wrote The Economist.

WIth India signing a deal with Iran to manage its Chabahar Port for the next 10 years, Modi’s port play has come to light. This is the first time India will take over management of a port overseas. The port, which is seen as India’s key connectivity link to Afghanistan, Central Asia and the larger Eurasian space, will help counterbalance Pakistan’s Gwadar port as well as China’s Belt and Road Initiative.

Chabahar has highlighted how India is expanding its geopolitical power by countering Chinese and Pakistani influence in the region and creating strategic footholds in other countries.

But Chabahar is also part of the ongoing port development in India which is a key component of Modi’s aim to turn the country into a manufacturing powerhouse. The Chabahar port pact should be music to the ears of domestic traders and exporters, ET has written. This is because the port will also serve as a key node in the International North-South Transport Corridor (INSTC), a multimodal transportation network that aims to connect South Asia to Europe and Russia via Iran.

The government says plans are underway to connect Chabahar to the INSTC, allowing Indian traders to reach Central Asia with greater ease and more cost-effectively. Trade experts explain that this will mean efficient access to Iran, Russia, Azerbaijan, and the Baltic and Nordic countries — and not just the 11 countries in Central Asia. They also point out that the INSTC is being seen as an alternative to the Suez Canal trade route which remains vulnerable to regional conflicts.Energy, pharmaceuticals, information technology, health, agriculture, textiles, and gems and jewellery can benefit greatly once India starts leveraging Chabahar port for the INSTC route, Nisha Taneja, a professor at Indian Council for Research on International Economic Relations (ICRIER), has told ET.While the Chabahar port pact has hogged the headlines due to its geopolitical importance and the risk it carries of US sanctions against India, a silent transformation of India’s port sector is on which doesn’t figure prominently in popular discourse since ports are not visible to everyone like highways and trains are.

India’s mega port push

Inaugurating three major infrastructure projects in Kochi in January, Modi said Indian ports have achieved double-digit annual growth in the past 10 years and beaten many developed nations in ship turnaround time. Earlier, ships had to wait long hours at ports and unloading took very long. “Today, the situation has changed,” he said.

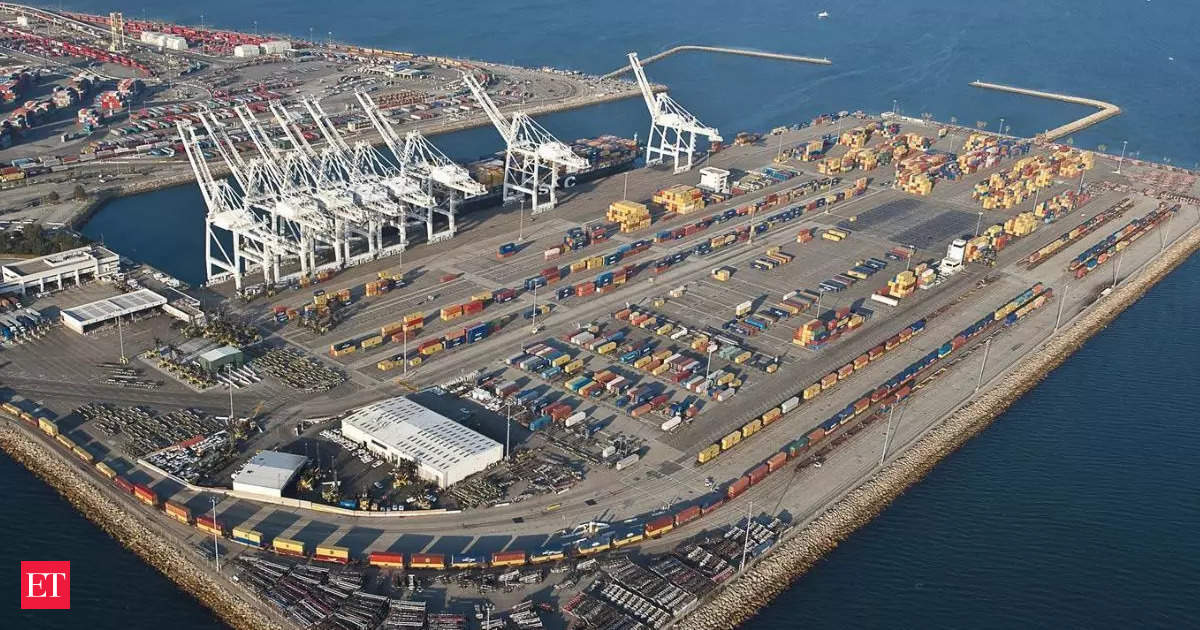

The capacity at India’s dozen major ports has doubled in the past 10 years from 745 mt to over 1,600 mt, The Economist has written. Traffic at these ports, which handle more than half of India’s trade, jumped by 46% to 795 mt in the 10 years to 2023. Turnaround time, or the number of hours between the arrival and departure of a cargo ship, has plummeted from 127 hours in 2010-11 to 53 hours ten years later. The maritime sector accounts for 95% of India’s trade by volume and 65% by value.

India’s ambition to become a manufacturing powerhouse as well as the world’s factory got a boost with a key project by the Adani Group getting the government nod recently. Adani’s Vizhinjam Port in Kerala has received the shipping ministry’s approval for operating as India’s first transshipment port. It will be India’s first full-fledged deepwater transshipment port. Located strategically between the Suez Canal and the Strait of Malacca, the port will put India on the map of global sea trade.

The proximity to the international shipping routes that account for 30% of global cargo traffic and a natural channel that goes up to 24 meters below the sea makes the port an ideal hub for some of the world’s biggest ships to call in, as per Bloomberg. Until now, the biggest container ships have been skipping India because its harbors weren’t deep enough to handle such vessels and docking at neighboring ports such as Colombo, Dubai, Singapore and Malaysia.

Ports play a crucial role in making a nation a powerhouse of manufacturing and exports. China is the prime example: the country has seven of the 10 busiest container ports in the world. Poor shipping connectivity has hindered India’s integration into the global value chain, the Reserve Bank of India said in a 2022 report. India’s container traffic was only 17 million TEUs (twenty-foot equivalent unit, is a measure of volume in units of twenty-foot long containers) in 2020 versus China’s 245 million TEUs, the ports ministry in February. That makes India’s container traffic less than 10% of China’s.

To boost its cargo handling capacity and host large vessels, India is constructing another port, the Vadhavan port in Dahanu, 150 km north of Mumbai.

India’s maritime vision

Ports at Vizhinjam and Vadhavan are part of the government’s Maritime India Vision 2030 that seeks to develop world-class mega ports, transshipment hubs and modernize infrastructure.

As part of the Amrit Kaal Vision 2047, India has six mega ports on the anvil as part of its maritime expansion plans. According to official estimates, around Rs 15-20 lakh crore of this investment will be needed in raising the country’s port handling capacity by 2047. This investment will come handy for increasing port handling capacity by four times, creating maritime clusters along Indian ports, and developing three islands as hubs for bunkering, ship repair, and Vessel Spares and Stores, among others.